In the cosmic collision of dreams and dread Brexit has become, one hope refuses to die: That a full-blown market panic can force politicians to overcome bitter division and agree a path to save the U.K. from economic catastrophe.

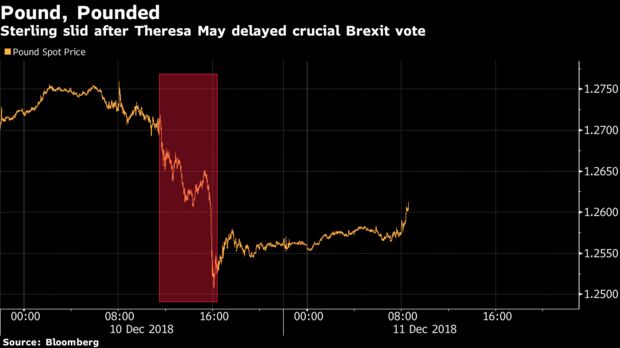

It’s known as the TARP scenario, after the Troubled Asset Relief Program passed by U.S. lawmakers to avert disaster in the financial crisis. In a hint of the pressures that some investors hope could focus Westminster minds, the pound slid to the lowest since April 2017 on Monday after Prime Minister Theresa May delayed a crunch vote on her deal to exit the European Union, pushing the U.K. even closer to a cliff edge.

“Stress in financial markets and pressure from businesses should lead to a last-minute approval of the deal in Parliament,” said Silvia Dall’Angelo, senior economist at Hermes Investment Management. Still, she admits this is a “low confidence” base case.

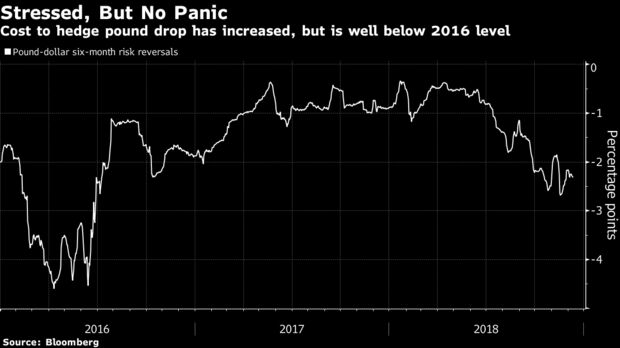

The trouble is that, so far, the markets aren’t playing ball. Despite the pound’s drop on Monday, trading in sterling options shows few signs of panic. The cost of hedging a decline in the currency against the dollar over the next six months -- a period which includes the March 29 deadline for Britain to exit the EU -- has increased but remains below levels seen in November, and well off the extremes reached in 2016.

Sterling gave up an advance on Tuesday, edging 0.1 percent lower to $1.255 as of 3:49 p.m. in London.

With foreign revenues posted by multinational companies benefiting from a weaker pound and a bond rally effectively lowering U.K. government borrowing costs, there are few signs of an impending crash to capture political attention.

“I don’t think we are there yet,” Charles St-Arnaud, an investment strategist at Lombard Odier Asset Management in London, said by email. “Once cable falls below the post-referendum lows (or below $1.20), they may get anxious. The panic may come when gilts starts to sell off because foreign investors have lost faith in the government. But we haven’t seen that yet. There seems to be good demand for gilts at the moment, sending yields lower.”

Earlier this month, Prudential Plc’s M&G Investments and Pictet Asset Management SA, which oversee a combined $800 billion, argued that pound vigilantes lack the power to spark legislative redress since the currency trades at historically cheap levels.

“There’s no visible doom-loop mechanism,” said Jim Leaviss, the head of retail fixed interest at M&G and founder of the Bond Vigilantes blog. “I don’t think Mr. Market gets us out of this mess.”

For a British reprise of TARP, declines in stocks would have to be severe enough to threaten bank solvency and recall crisis-era rescue scenarios, he said.

Investors also aren’t buying the Bank of England’s warning that it might be forced to raise rates -- inflicting pain on consumers and homeowners in its wake. On Monday, money markets wagered the next interest-rate increase from the Bank of England will not happen until the second half of 2020.

Rate Bets Pushed Out

And TARP is a theory that contains the seeds of its own destruction -- the more investors bank on a benign compromise in the 11th hour spurred by market pressure, the less likely that pressure will emerge.

“The result is a long period of weak confidence and a weak exchange rate, but no acute crisis,” Ethan Harris, economist at Bank of America Corp., wrote in a Monday note. “It may require a true hard deadline -- currently the end of March -- to force a deal.”

Komentar

Posting Komentar